zheniya.ru Tools

Tools

How Much Is An Exterminator For Carpenter Ants

If you sense trouble, call Fox Pest Control. We'll send a licensed and certified technician to your home to get rid of carpenter ants today! BBB Accredited. Piles of fine sawdust are a clear sign of carpenter ants in the house and a likely need for carpenter ant extermination. In Canada, the ant extermination cost starts at $ and potentially reaching up to $1, On average, homeowners can expect to spend about $ for ant. Those who would ask how much does an exterminator cost for ants may be surprised at the answer. An ant exterminator cost can vary between $ to $1, Carpenter Ant Control"Professional Pest Control Products & Supplies" Carpenter ant control Carpenter Ants taking Advance Carpenter Ant Bait Non-repellent. To get rid of carpenter ants quickly, try D-Fense Insecticide Dust. It is an effective and fast-acting chemical dust, but it does contain toxic chemicals. Treating carpenter ants costs somewhere in the range of $ and $ These ants are famously hard to dispose of which is the reason extermination runs on the. Discover how to get rid of carpenter ants. Pesticon Pest Control provides carpenter ant services in Toronto and the greater GTA. Contact us for a quote. Hiring a professional pest control company to treat a carpenter ant infestation can cost anywhere from $ to $ or more, depending on the severity of the. If you sense trouble, call Fox Pest Control. We'll send a licensed and certified technician to your home to get rid of carpenter ants today! BBB Accredited. Piles of fine sawdust are a clear sign of carpenter ants in the house and a likely need for carpenter ant extermination. In Canada, the ant extermination cost starts at $ and potentially reaching up to $1, On average, homeowners can expect to spend about $ for ant. Those who would ask how much does an exterminator cost for ants may be surprised at the answer. An ant exterminator cost can vary between $ to $1, Carpenter Ant Control"Professional Pest Control Products & Supplies" Carpenter ant control Carpenter Ants taking Advance Carpenter Ant Bait Non-repellent. To get rid of carpenter ants quickly, try D-Fense Insecticide Dust. It is an effective and fast-acting chemical dust, but it does contain toxic chemicals. Treating carpenter ants costs somewhere in the range of $ and $ These ants are famously hard to dispose of which is the reason extermination runs on the. Discover how to get rid of carpenter ants. Pesticon Pest Control provides carpenter ant services in Toronto and the greater GTA. Contact us for a quote. Hiring a professional pest control company to treat a carpenter ant infestation can cost anywhere from $ to $ or more, depending on the severity of the.

Carpenter Ants. Carpenter Ant. Pest Control: How to Get Rid of Carpenter Ants. A full interior and exterior treatment consist of a visual inspection of “hot. The average cost of a single ant treatment is $ If your property requires repeated treatments, most exterminators offer discounts when you combine them. Inside-Out offers effective control with two leading-edge products: Termidor (for undetectable ant control outside) and Phantom (for undetectable ant and. Shed wings: After establishing a new colony, swarmers will shed their wings. Need Help From an Ant Exterminator? How Much Damage Do Carpenter Ants Do? How much does an exterminator cost for carpenter ants? The cost of a carpenter ants exterminator varies depending on the pest control treatment plan. Get. Kill Ants, Carpenter Ants, and Fire Ants Indoors and Outdoors Nationally, homeowners will spend around $ for an ant removal service. The total cost will be. I have contracted for a quarterly program at a very reasonable price. Very impressed! Response from the owner: Glad you have you on our quarterly pest control. GreenLeaf Pest Control is more than just a carpenter ant exterminator in Toronto Sometimes pests use these branches to get into your home. Make sure that. Ant Control Frequently Asked Questions. How much does ant extermination cost? Due to the many species of ants, not all ant control methods cost the same. Option 2: $50 carpenter ant treatment on top of our one-shot pest treatment. Kansas City pest control. Have other bug problems besides ants? At Gunter Pest, we. The cost to exterminate ants ranges between $ and $, with the average homeowner spending $ on general ant treatment excluding fire and carpenter ants. Orkin Pros are trained to help manage carpenter ants and similar pests. Since every building or home is different, your Orkin Pro will design a unique carpenter. Advancements in pest control technology have recently led to more efficient treatments that allow carpenter They understand that if too little or too much. Here are 10 natural methods that we recommend you use to get rid of carpenter ants: Carpenter Ant Exterminator. Carpenter ants threaten the structure of. Carpenter ant control is a job for a pest management professional. The best carpenter ant removal comes by locating and treating the nest (indoors or out). Therefore with my limited knowledge I would estimate the exterminator may charge anywhere from $ to $ at most, to do the job for the. Structural Pest Control · Integrated Pest Management (IPM) · Frequently Asked A mature carpenter ant colony may contain as many as l0, individuals. When a part of well-established colony goes into a neighboring structural building, it establishes a much smaller satellite colony over there; some pest control. Contact us today at () for a free estimate and to get rid of the carpenter ants for good. Our ant control extermination team will arrive at your. Minuteman uses the latest technology and materials to treat for the carpenter ants, which have invaded your home. Minuteman goal is to eliminate your problem.

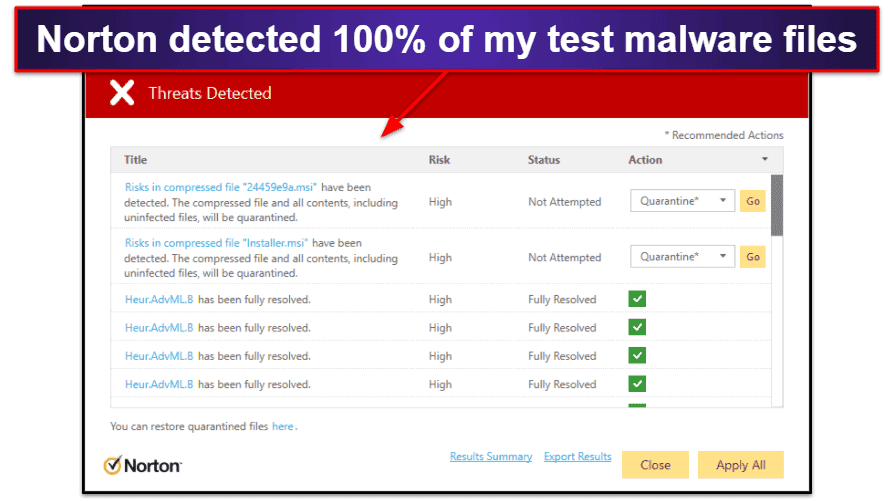

Does Norton Prevent Malware

Yes, Norton agents can help remove spyware from an Android device. Norton Spyware & Virus Removal is available for both iOS and Android. Check out Norton BT Virus Protect, powered by Norton, will keep your devices protected from harmful viruses. It will also warn you if you're about to visit a harmful website. Norton detects all types of malware, including viruses, Trojans, worms, and spyware. It also uses AI to detect potential threats, even if they're new and. When you are finished installing Method's sync engine, then you can re-enable Norton Auto-Protect. Depending on your version of Norton software, the steps for. I've never heard of anti-virus interfering with in-browser JavaScript in that way. My best guess would be that they have their virus scanner. We're so confident in our antivirus and malware protection, we offer a % guarantee. If your device gets a virus our Norton experts can't remove, you get your. Norton is a pioneer in antivirus. With Norton™ Spyware & Virus Removal service you remove spyware and viruses from your devices without leaving your home! Real-time malware protection. Starting with Norton, the antivirus works proactively to block threats before they can even reach your device. It kicks off with. Norton antivirus have a good firewall that Protects from Malware, Viruses, Trojans, etc. So, install it and check with yourself. Yes, Norton agents can help remove spyware from an Android device. Norton Spyware & Virus Removal is available for both iOS and Android. Check out Norton BT Virus Protect, powered by Norton, will keep your devices protected from harmful viruses. It will also warn you if you're about to visit a harmful website. Norton detects all types of malware, including viruses, Trojans, worms, and spyware. It also uses AI to detect potential threats, even if they're new and. When you are finished installing Method's sync engine, then you can re-enable Norton Auto-Protect. Depending on your version of Norton software, the steps for. I've never heard of anti-virus interfering with in-browser JavaScript in that way. My best guess would be that they have their virus scanner. We're so confident in our antivirus and malware protection, we offer a % guarantee. If your device gets a virus our Norton experts can't remove, you get your. Norton is a pioneer in antivirus. With Norton™ Spyware & Virus Removal service you remove spyware and viruses from your devices without leaving your home! Real-time malware protection. Starting with Norton, the antivirus works proactively to block threats before they can even reach your device. It kicks off with. Norton antivirus have a good firewall that Protects from Malware, Viruses, Trojans, etc. So, install it and check with yourself.

lets you know when your operating system has vulnerabilities, so you can take action to help protect your device against cybercriminals that could take control. Norton Antivirus detects and removes Trojan horses. Via LiveUpdate, administrators can download to a computer the latest virus definitions, which contain. NortonLifeLock offers comprehensive protection solutions for your Cyber Safety, helping to protect you and your family's Device Security, Identity Theft. Norton Internet Security, developed by Symantec Corporation, is a discontinued computer program that provides malware protection and removal during a. If you have a Windows PC, try the Norton Power Eraser next time your computer detects a threat. It is free to download and can remove both malware and viruses. How do I Disable Microsoft Defender virus protection? · Click Start > Settings > Update and Security · Click Windows Security from the left-hand menu · Select. Norton Antivirus is designed to prevent and remove virus, malware, Trojan and worm infections on your computer. Additionally, Norton Antivirus can remove. Malware Protection - Scans and removes apps with viruses, spyware and other threats. Ransomware Protection - Protects against ransomware attacks. Remote Locate. Norton Security Products (including Norton , Norton AntiVirus, Norton Internet Security, Norton One, Norton Small Business, Norton Security Protection, and. Norton™ provides industry-leading antivirus and security software for your PC, Mac, and mobile devices. Download a Norton™ plan - protect your devices. Yes, Norton includes an antivirus. Norton provides you with comprehensive all-in-one protection for your devices, online privacy, and identity. Help. Once you have a virus on your computer, it may attack Norton and prevent it from working properly; in these cases, the virus must be removed manually. Norton. It detected % of them, making it one of the best performers, on par with Bitdefender. Norton's real-time protection was stellar too, blocking malware files. Norton for mobile provides powerful layers of phone protection and award-winning mobile security for your Apple device. Norton's security suite is one of the best antivirus software you can get, giving you high malware detection rates and comprehensive real-time protection. Get privacy protection & mobile security for your Android device with Norton Safeguard your phone from malware, spyware, and online privacy risks with. Norton provides excellent security against cyber threats like malware, phishing scams, and network intrusions. It's among the industry's best antiviruses at. Norton AntiVirus is an anti-virus or anti-malware software product founded by Peter Norton, developed and distributed by Symantec (now Gen Digital) since. For Norton Antivirus Plus, you'll get virus, malware, and ransomware protection, a password manager, and online threat protection. You can install the software.

Where Can I Save Money

There are a bunch of excellent apps designed to help you budget more effectively and save your cash. We've chosen some of our favorites below. We've put together a list of 33 simple changes to save you a little cash. All you need to turn each one into BIG savings is drumroll, please to make it a habit! 10 Best Ways to Save Money · 1. Eliminate Your Debt · 2. Set Savings Goals · 3. Pay Yourself First · 4. Stop Smoking · 5. Take a Staycation · 6. Spend to Save. Here are ten tips on how to save money that you can take to the bank. 1. Track your spending. One of the greatest contributors to overspending is a credit card. From baby clothes to bikes to band equipment, here are 8 things you should always buy used to save money. There are tons of ways to cut back on everyday expenses that take pretty much no time, money or effort. Start some of these up, and you could find yourself. Find It in Your Expenses · Look for an expense to cut and save that money. Some people suggest that you increase your savings by cutting back on lattes or. These three platforms offer ways for Millennials to put more money back into their budget by doing the things they already do — but better. Want to save money for an emergency fund or just because you know it's important? Here are a few tips to help you make some tax-savvy investing moves. There are a bunch of excellent apps designed to help you budget more effectively and save your cash. We've chosen some of our favorites below. We've put together a list of 33 simple changes to save you a little cash. All you need to turn each one into BIG savings is drumroll, please to make it a habit! 10 Best Ways to Save Money · 1. Eliminate Your Debt · 2. Set Savings Goals · 3. Pay Yourself First · 4. Stop Smoking · 5. Take a Staycation · 6. Spend to Save. Here are ten tips on how to save money that you can take to the bank. 1. Track your spending. One of the greatest contributors to overspending is a credit card. From baby clothes to bikes to band equipment, here are 8 things you should always buy used to save money. There are tons of ways to cut back on everyday expenses that take pretty much no time, money or effort. Start some of these up, and you could find yourself. Find It in Your Expenses · Look for an expense to cut and save that money. Some people suggest that you increase your savings by cutting back on lattes or. These three platforms offer ways for Millennials to put more money back into their budget by doing the things they already do — but better. Want to save money for an emergency fund or just because you know it's important? Here are a few tips to help you make some tax-savvy investing moves.

There are a bunch of excellent apps designed to help you budget more effectively and save your cash. We've chosen some of our favorites below. Here we cover some more general savings options. The aim is to earn as much interest as possible from the money you save. Here are 25 ideas for saving more money. The good news is that there's no one thing you have to cut out. If it really matters to you, go ahead and keep. Making a budget, automating your savings, and choosing a night in over an expensive evening out are all great ways to save. 7 steps to start saving money: A comprehensive guide to saving, budgeting, and investing for a better financial future. We'll cover everything from setting goals and creating budgets to earning and saving on expenses. We'll also dive into important topics such as banking and. That means each pay period, before you are tempted to spend money, commit to putting some in a savings account. See if you can arrange with your bank to. 20 tips for maximizing savings. 1. Create a budget plan. Creating a budget is the first and most important step toward figuring out how to save money. Use the tools below to set your financial goals and calculate how much money a month you need to set aside to make your goals and adventures happen! We've categorized each item by one-time, daily, monthly, or annual ways to save. The trick is to start with the tips that actually work for you and your. save money but don't? What are some simple life hacks people could be doing to save them some money? Archived post. New comments cannot be. The best money market accounts earn way more than the national average. For example, the Quontic Money Market Account has a stellar % APY. These steps can help you cut through the financial noise in your life and start to save money, whether it's for a short-term goal, like a vacation, or a longer. With these strategies, culled from the US News Frugal Shopper blog, you'll be able to save your cash and have more time to enjoy those savings. Saving money means that you find ways to pay less money when you shop. Saving money means paying the best price for the things you want to buy. Checking accounts. One option is to open a checking account at a bank or credit union where your money will be protected and insured. Checking accounts give you. To save effectively, it's important to have goals, a monthly budget and a plan to stay on track. Consider these tips to help you put more money away. Making the effort to save your money may protect you in the event of a financial emergency. It can also help you pay for large purchases, avoid debt, reduce. Ultimate Guide to Saving Money · 1. Set Savings Goals · 2. Monitor Your Spending Closely · 3. Establish a Budget · 4. Spend Less, Save More · 5. Cut Out.

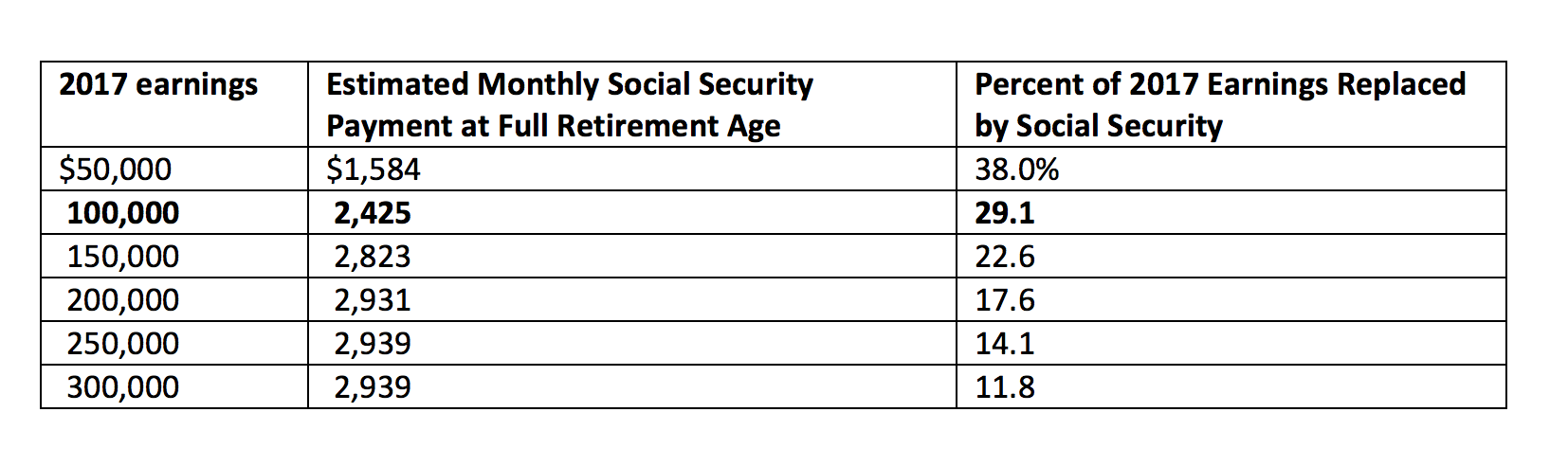

How Much Would I Receive If I Retire At 62

Visit a local Social Security office to get a record of your taxed Social Security earnings and an estimate of retirement benefits (though it won't take into. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. If you start collecting your benefits at age 65 you could receive approximately $33, per year or $2, per month. This is % of your final year's income. Example:If you were receiving $ as your monthly benefit, upon your death your contingent annuitant would receive $ (one-half) for the rest of his/her. If you have 10 or more years of service and retire at the Minimum Retirement Age (MRA), your benefit will be reduced by 5/12 of 1% for each full month (5% per. What should I do if I don't receive my retirement benefit payment or if my When do I receive a COLA increase and how much will it be? A. Eligible. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. A person can receive retirement benefits before their FRA as early as age However, the benefits will be reduced based on when a person chooses to receive. Understanding your Social Security benefits is an important part of retirement planning. Use SmartAsset's calculator to determine what your benefits will. Visit a local Social Security office to get a record of your taxed Social Security earnings and an estimate of retirement benefits (though it won't take into. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. If you start collecting your benefits at age 65 you could receive approximately $33, per year or $2, per month. This is % of your final year's income. Example:If you were receiving $ as your monthly benefit, upon your death your contingent annuitant would receive $ (one-half) for the rest of his/her. If you have 10 or more years of service and retire at the Minimum Retirement Age (MRA), your benefit will be reduced by 5/12 of 1% for each full month (5% per. What should I do if I don't receive my retirement benefit payment or if my When do I receive a COLA increase and how much will it be? A. Eligible. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. A person can receive retirement benefits before their FRA as early as age However, the benefits will be reduced based on when a person chooses to receive. Understanding your Social Security benefits is an important part of retirement planning. Use SmartAsset's calculator to determine what your benefits will.

If you wait until 67 to get the , after 15 years you will have collected the same amount as if you started at age 65 at /month. This. Based on the information you gave, you could get Social Security retirement benefits beginning at age 62 if you have enough work credits. Would you like an. There is no guarantee you will receive the amounts shown on these online estimates. If any of the following circumstances apply to you, this calculator will. Your basic early retirement benefit at age 60 would be $ per month. HAZARDOUS DUTY RETIREMENT. YOU MAY RETIRE WITH A BENEFIT AT ANY AGE IF YOU HAVE Specifically, if you are under full retirement age for the entire year, $1 in benefits will be withheld for every $2 you earn over the annual earnings limit ($. If your retirement formula is 2% at 62, for example, this means you get 2% of your pay if you retire at age Age 62 is referred to as your “normal. You can get Social Security retirement benefits as early as age. However, you will receive a reduced benefit if you retire before your full retirement age. This is how much you would receive at your full retirement age — 65 or older You can begin to receive. Social Security benefits as early as age As the table demonstrates, even if you spend a full career in public service, your retirement benefit will only be a fraction of the wages you received while. Members who otherwise qualify for a retirement based on longevity of service will also receive Also, DIEMS does not determine when creditable service. For example, if you start claiming benefits at age 62, 60 months before you turn 67, your benefit will be reduced by 30% (36 x% plus 24 x%). The. For example, say you were born in , and your full retirement age is If you start your benefits at age 69, you would receive a credit of 8% per year. Full retirement age ; Monthly benefit at age 62, $ ; Monthly benefit at full retirement age, $ ; Monthly benefit at age 70, $. You can retire at 62 with $, if you can live off a meager $15, annually, not including Social Security Benefits, which you are eligible for now or. Step 1: Explore how the age you start collecting Social Security affects your retirement benefits. Enter your information below. When the full-benefit age reaches 67, benefits taken at age 62 will be reduced to 70 percent of the full benefit and benefits first taken at age 65 will be. You can retire and collect Social Security benefits any time after age You will have to pay taxes on your benefits if you file a federal tax return. If you would have been entitled to $1, a month at full retirement age, you will get about $ if you start benefits when you turn Your income might. You can collect Social Security retirement benefits at age 62 and still work. If you earn over a certain amount, however, your benefits will be temporarily. Under this example, if you were eligible for $1, a month at your full retirement age of 67 then the benefit would be reduced to $ a month if you claimed.

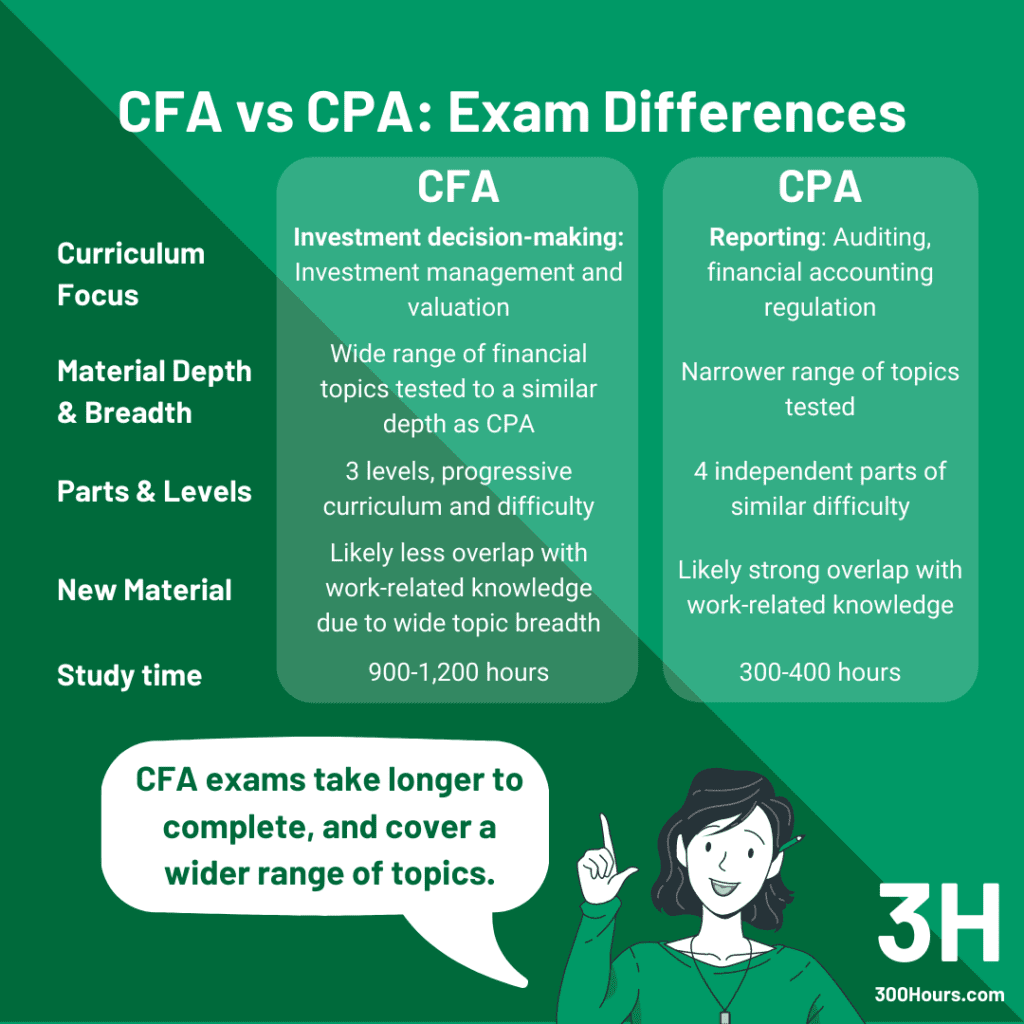

Cpa And Cfp

Exam Content and Difficulty: The CFP® exam covers comprehensive financial planning and requires candidates to apply knowledge in real-life scenarios. The CPA. If you're a CFP and fee based, then it could help in addition to your CPA. Depends on your market too, most regular folk don't know that CPAs do financial. CPAs concentrate on accounting and auditing, CFAs operate in the finance space, focusing on financial analysis and portfolio management, while CFPs are experts. CFP® – CERTIFIED FINANCIAL PLANNER™ professional · CPA – Certified Public Accountant · PFS – Personal Financial Specialist · CWS – Certified Wealth Strategist · AIF. as a tax CPA, auditor, and forensic accountant for Not-for-profits, LLCs, S-Corps, and individuals. I joined Raymond James & Associates in where I became a. Personal Financial Specialist (PFS SM) – The PFS credential demonstrates that an individual has met the minimum education, experience and testing required of a. However, the CFP certification indicates that a financial planner holds many years of industry experience. CFPs focus on financial planning, but their clients. The CFP® designation is not awarded by CSI. It is granted under license by the Financial Planning Standards Council to those who have met its educational. Individuals who hold one of the following qualifications in good standing; CPA, CFA, FCIA, or LL.B./J.D., may pursue the Relevant Professional Qualifications. Exam Content and Difficulty: The CFP® exam covers comprehensive financial planning and requires candidates to apply knowledge in real-life scenarios. The CPA. If you're a CFP and fee based, then it could help in addition to your CPA. Depends on your market too, most regular folk don't know that CPAs do financial. CPAs concentrate on accounting and auditing, CFAs operate in the finance space, focusing on financial analysis and portfolio management, while CFPs are experts. CFP® – CERTIFIED FINANCIAL PLANNER™ professional · CPA – Certified Public Accountant · PFS – Personal Financial Specialist · CWS – Certified Wealth Strategist · AIF. as a tax CPA, auditor, and forensic accountant for Not-for-profits, LLCs, S-Corps, and individuals. I joined Raymond James & Associates in where I became a. Personal Financial Specialist (PFS SM) – The PFS credential demonstrates that an individual has met the minimum education, experience and testing required of a. However, the CFP certification indicates that a financial planner holds many years of industry experience. CFPs focus on financial planning, but their clients. The CFP® designation is not awarded by CSI. It is granted under license by the Financial Planning Standards Council to those who have met its educational. Individuals who hold one of the following qualifications in good standing; CPA, CFA, FCIA, or LL.B./J.D., may pursue the Relevant Professional Qualifications.

Sacramento Certified Financial Planner, CFP® & Certified Public Accountant, CPA | Steve Pitchford, Sacramento CFP® & CPA near me. CFP is a professional certification for financial planners granted by the CFP board. In order to become a certified financial planner, an individual must have a. At Cindy Courtney, CPA, CFP®, PLLC, our clients enjoy knowing that customized financial planning and tax preparation services are offered under one roof by a. Certified Public Accountant (CPA), New Jersey · CERTIFIED FINANCIAL PLANNER™ (CFP®) · B.S. Accounting, Rutgers University · Upstream Academy's Emerging Leaders. The Accelerated Path allows you to bypass much of the coursework requirement for CFP® certification, if you hold a CPA, CFA, ChFC, CLU, licensed attorney, etc. Anthony J. Wrobel, CPA, CFP® Anthony J. Wrobel is a Member of the Firm. He is a licensed Certified Public Accountant and CERTIFIED FINANCIAL PLANNER™ in New. CPA, CFP® Will is a Partner and senior advisor with Financial Symmetry. He holds the Certified Public Accountant and Certified Financial Planner™ designations. I would judge the difference in terms of practice. For servicing customers that do investing, CFP is key. For customers with accounting issues. Sacramento Certified Financial Planner, CFP® & Certified Public Accountant, CPA | Steve Pitchford, Sacramento CFP® & CPA near me. John is a firm believer in financial literacy. He was a co-chair of the California Society of CPA's Financial Literacy Committee. He also founded Financial. Learn how the CFA Program differs from the MBA, CPA, and CFP with CFA Institute. Compare financial credentialing programs to find the best one for you! CPA & CFP® Fee Only Fiduciary Registered Investment Advisory Firm specializing in tax planning, comprehensive financial planning & tax efficient investing. Certified Financial PlannerTM Professional (CFP®). CERTIFIED FINANCIAL PLANNERTM Professionals, also known as CFP® Professionals, approach taxes in a very. Alternatively, CPAs who have passed the CFP or ChFC exams do not need to take the PFS exam and are deemed to have met the exam requirement. PFP Certificate. The financial planning community is a much smaller fraternity than the CPA community. And when you're a sole practitioner like me, it can sometimes feel like. The Accelerated Path allows you to bypass much of the coursework requirement for CFP® certification, if you hold a CPA, CFA, ChFC, CLU, licensed attorney. Beacon Hill Financial Educators CE and CPE Self Study and Online Courses | Continuing professional education courses for Certified Financial Planners (CFP. When it comes to financial and tax advice, both CPAs (Certified Public Accountants) and CFPs (Certified Financial Planners) are trained to. CPA & CFP® Fee Only Fiduciary Registered Investment Advisory Firm specializing in tax planning, comprehensive financial planning & tax efficient investing. benefits of choosing a CPA and CFP® · related materials · Related Materials. The Added Value of Financial Advisors Download. Download. Benefits of working.

How Much Should I Make To Buy A 450k House

If the home you buy is in an HOA, the fee will count as part of your housing costs.» MORE: How much money do you really need to buy a house? ADVERTISEMENT. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. If you follow the recommended 28/36% rule, spending no more than 28% of your gross monthly income on home-related costs and no more than 36% on total debts. This does not include upfront mortgage insurance if needed. Your salary must meet the following two conditions on FHA loans: - The sum of the monthly mortgage. How much investment property can I afford? Lenders compare your debt and income to determine how large a monthly payment you can afford. They'll divide the. This means you'd need to earn between £90, and £, to afford a £k mortgage. Income Multiple, Required Salary. 3X, £, X, £, 4X, £. Wondering how much you need to make to qualify for a mortgage? Use our mortgage required income calculator to get an idea of how much mortgage you can afford. The annual salary needed to afford a $, home is about $, Photo illustration by Fortune; Original photo by Getty Images. Over the past few years. Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan. If the home you buy is in an HOA, the fee will count as part of your housing costs.» MORE: How much money do you really need to buy a house? ADVERTISEMENT. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. If you follow the recommended 28/36% rule, spending no more than 28% of your gross monthly income on home-related costs and no more than 36% on total debts. This does not include upfront mortgage insurance if needed. Your salary must meet the following two conditions on FHA loans: - The sum of the monthly mortgage. How much investment property can I afford? Lenders compare your debt and income to determine how large a monthly payment you can afford. They'll divide the. This means you'd need to earn between £90, and £, to afford a £k mortgage. Income Multiple, Required Salary. 3X, £, X, £, 4X, £. Wondering how much you need to make to qualify for a mortgage? Use our mortgage required income calculator to get an idea of how much mortgage you can afford. The annual salary needed to afford a $, home is about $, Photo illustration by Fortune; Original photo by Getty Images. Over the past few years. Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan.

The monthly payment for a year $, mortgage could range from $2, to $3, Depending on your rate and loan term, you could pay more than $, in. house poor.” How much do I need to make to buy a K house? A salary between $, and $, will help you afford a k home. But of course. How Do Interest Rates Affect the Monthly Payment of a k Home Over 30 Years? ; %, $,, $90,, $,, 30 years ; %, $,, $90, make payments of $2, Payment stated does not include taxes How much home can you afford? Estimate your buying power and set your budget. To afford a house that costs $, with a down payment of $90,, you'd need to earn $97, per year before tax. The mortgage payment would be $2, /. Do I qualify for a VA mortgage loan? A Veteran Affairs (VA) loan is a mortgage loan for Service members, Veterans and eligible surviving spouses. Contact a. How Much Home. What's the Down Payment for a , Home? Use the calculator to determine the down payment and monthly payment of a k house. Purchase Price. *Financial advisors recommend purchasing a house where your monthly payment is approximately 28% of your total income. Based on your information, you can afford. afford? How much do I need to make to afford a $, home? And how much can I qualify for with my current income? We're able to do this by not only. Our down payment calculator helps estimate your mortgage based on how much money you use as a down payment on a house. Learn how much you should put down. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. To afford a $, mortgage you will need to be making approximately $, per year. However, choosing to get a mortgage without making a down payment. The monthly payment on a k mortgage is $3, You can buy a $k house with a $50k down payment and a $k mortgage. Down Payment on a House: How Much Do You Really Need? by Kate Wood. Other NerdWallet resources. Compare mortgage rates. Save hundreds a year with a lower rate. Our home affordability calculator considers the following factors: Annual income (before taxes); Down payment; Monthly debt payments; Desired loan term. The annual salary needed to afford a $, home is about $, Photo illustration by Fortune; Original photo by Getty Images. Over the past few years. How Much House Can I Afford? Mortgage Lender Reviews. Rocket Mortgage Review income to safely afford your new home. Recommended Minimum Savings. To afford a house that costs $, with a down payment of $70,, you'd need to earn $75, per year before tax. The mortgage payment would be $1, /. Two criteria that mortgage lenders look at to understand how much you can afford are the housing expense ratio, known as the “front-end ratio,” and the. Lenders commonly offer loans up to four times your annual salary. For a £k mortgage, an ideal annual income would be around £,, although this can vary.

Spmd Stock Price

Day Low-High, ; 52wk Low-High, ; Volume, , ; NAV (month end), ; Premium (+)/Discount (-) (month end), SPDR Portfolio Mid Cap ETF (SPMD) · Invest in SPMD · About SPDR Portfolio Mid Cap ETF (SPMD) · SPMD Stock News · Frequently Asked Questions (FAQ) · How to buy SPMD. SPMD - SPDR Portfolio S&P Mid Cap ETF ; NAV, ; PE Ratio (TTM), ; Yield, % ; YTD Daily Total Return, % ; Beta (5Y Monthly), All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at. Stock Price and Dividend Data for SPDR Portfolio S&P Mid Cap ETF/SPDR Series Trust (SPMD), including dividend dates, dividend yield, company news. A high-level overview of SPDR® Portfolio S&P ™ Mid Cap ETF (SPMD) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. SPDR Portfolio S&P Mid Cap ETF SPMD:NYSE Arca ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High About SPMD ; Asset Class Equity ; Category Mid-Cap Blend ; Region North America ; Stock Exchange NYSEARCA ; Ticker Symbol SPMD. View the latest SPDR Portfolio S&P Mid Cap ETF (SPMD) stock price and news, and other vital information for better exchange traded fund investing. Day Low-High, ; 52wk Low-High, ; Volume, , ; NAV (month end), ; Premium (+)/Discount (-) (month end), SPDR Portfolio Mid Cap ETF (SPMD) · Invest in SPMD · About SPDR Portfolio Mid Cap ETF (SPMD) · SPMD Stock News · Frequently Asked Questions (FAQ) · How to buy SPMD. SPMD - SPDR Portfolio S&P Mid Cap ETF ; NAV, ; PE Ratio (TTM), ; Yield, % ; YTD Daily Total Return, % ; Beta (5Y Monthly), All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at. Stock Price and Dividend Data for SPDR Portfolio S&P Mid Cap ETF/SPDR Series Trust (SPMD), including dividend dates, dividend yield, company news. A high-level overview of SPDR® Portfolio S&P ™ Mid Cap ETF (SPMD) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. SPDR Portfolio S&P Mid Cap ETF SPMD:NYSE Arca ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High About SPMD ; Asset Class Equity ; Category Mid-Cap Blend ; Region North America ; Stock Exchange NYSEARCA ; Ticker Symbol SPMD. View the latest SPDR Portfolio S&P Mid Cap ETF (SPMD) stock price and news, and other vital information for better exchange traded fund investing.

An easy way to get SPDR Portfolio S&P Mid Cap ETF real-time prices. View live SPMD stock fund chart, financials, and market news. View Spdr Portfolio S&P Mid Cap Etf (SPMD) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. View the real-time SPMD price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. SPDR Portfolio S&P Mid Cap ETF (SPMD). Summary · Chart · Dividends. SPMD Summary. Price, , P/E (Trailing). Change, , P/E (Forward). Change %, %. SPMD – SPDR® Portfolio S&P ™ Mid Cap ETF – Check SPMD price, review total assets, see historical growth, and review the analyst rating from Morningstar. Latest SPDR Portfolio S&P Mid Cap ETF (SPMD) stock price, holdings, dividend yield, charts and performance. Get SPDR Portfolio S&P Mid Cap ETF (SPMD.C) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. What Is the SPMD Stock Price Today? The SPMD stock price today is What Stock Exchange Is SPMD Traded On? SPMD is listed and trades on the NYSE stock. Component Grades · A · C · Get Rating · C · SPMD Price/Volume Stats - 7 Best ETFs for the NEXT Bull Market · SPMD Stock Price Chart Interactive Chart > · SPDR. SPDR Portfolio S&P Mid Cap ETF (SPMD) - stock quote, history, news and other vital information to help you with your stock trading and investing. SPDR Series Trust - SPDR Portfolio S&P Mid Cap ETF (NYSEMKT: SPMD). $ (%). $ Price as of July 31, , p.m. ET. Jump to: Overview. (SPMD). News, analyses, holdings, benchmarks, and quotes SPMD Trading Summary. Impediment to Creations. Creation Unit Size (Shares). Creation Unit. Nasdaq provides after-market quotes of stock trades from P.M. EST to P.M. EST. After Hours participation from Market Makers and ECNs is strictly. View the real-time SPMD price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. SPMD support price is $ and resistance is $ (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility. Instrument Name SPDR Mid Cap Portfolio ETF Instrument Symbol (SPMD-A). Instrument Exchange NYSE Arca ; Previous Close ; Week High/Low ; Volume. Tuesday, 18th Jun SPMD stock ended at $ This is % more than the trading day before Monday, 17th Jun During the day the stock fluctuated. Component Grades · A · C · Get Rating · C · SPMD Price/Volume Stats - 7 Best ETFs for the NEXT Bull Market · SPMD Stock Price Chart Interactive Chart > · SPDR. SPMD ; VWAP: ; Option Volume: 8 ; Day IV: + ; IV30 % Rank: 91% Elevated ; Technical: Top Pullback We analyzed and compared the stock moving averages.

How Can I Invest In Google

Both apple and google are fantastic companies. But in order to have strong returns you need to pick a GOOD company at the RIGHT price. Find the latest Alphabet Inc. (GOOG) stock quote, history, news and other vital information to help you with your stock trading and investing. How to Buy Stock in Google · Figure out where to buy Google stock · Open a brokerage account · Deposit funds into your brokerage account · Analyze Google stock. This retirement plan has millions of dollars invested in fossil fuels, deforestation-risk agribusiness, and arms manufacturers. You can invest in Alphabet shares with IG's share dealing service. By investing in Alphabet shares, you will own them outright, meaning that you will have to. The YouTube deal was great, but Android delivered an even better return on a smaller investment. 3. DoubleClick: $ billion, % ownership since The. Just contact any investment company like Fidelity, Schwab, Vanguard, etc., and purchase shares in the companies you are interested in. About this app. arrow_forward. Acorns helps you invest and save for your future. With nearly $4,,, in Round-Ups® invested and counting, we are an. The stock remains a safe investment due to the dominance of its search business and massive cash holdings. Both apple and google are fantastic companies. But in order to have strong returns you need to pick a GOOD company at the RIGHT price. Find the latest Alphabet Inc. (GOOG) stock quote, history, news and other vital information to help you with your stock trading and investing. How to Buy Stock in Google · Figure out where to buy Google stock · Open a brokerage account · Deposit funds into your brokerage account · Analyze Google stock. This retirement plan has millions of dollars invested in fossil fuels, deforestation-risk agribusiness, and arms manufacturers. You can invest in Alphabet shares with IG's share dealing service. By investing in Alphabet shares, you will own them outright, meaning that you will have to. The YouTube deal was great, but Android delivered an even better return on a smaller investment. 3. DoubleClick: $ billion, % ownership since The. Just contact any investment company like Fidelity, Schwab, Vanguard, etc., and purchase shares in the companies you are interested in. About this app. arrow_forward. Acorns helps you invest and save for your future. With nearly $4,,, in Round-Ups® invested and counting, we are an. The stock remains a safe investment due to the dominance of its search business and massive cash holdings.

is for Google · Getting more ambitious things done. · Taking the long-term view. · Empowering great entrepreneurs and companies to flourish. · Investing at the. At zheniya.ru, we strive to revolutionize stock analysis by integrating AI with extensive financial data. We see the transformative potential of AI in the. Find the right investing platform for you. To buy GOOGL shares in Australia, you'll need to open an account with an investing platform that offers the security. How to buy Google shares · Step 1: Choose a broker · Step 2: Decide how much you want to invest · Step 3: Review GOOG stock performance and potential · Step 4. Click Add investments. Enter the stock, mutual fund, or cryptocurrency you want to add, and select the correct option that appears as you type. Enter the. Figure out where to buy Google stock; Open a brokerage account; Deposit funds into your brokerage account; Analyze Google stock; Make your GOOGL trade; Get. Google to Invest $10 Billion in India. Eric Bellman. minutes. Alphabet Inc.'s Google is tightening its ties to India with a $10 billion fund to profit from. 6/16/ About GOOGL. Alphabet Inc. is a holding company. The Company's businesses include Google. Google's other revenue is from sales of apps and content on Google Play and Oracle Hits Record High: Should You Invest After Q1 Cloud Success? 1. How to Invest · Virtual Stock Exchange · Video · MarketWatch 25 It operates through the following segments: Google Services, Google Cloud, and Other Bets. time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading and investment decisions. It is important to remember that, when buying Google shares, you are buying a part of the company, meaning that the success of your investment is reliant on the. Get Google stock quote in real-time, analyze price movement and start CFD trading using our advantages of tight spreads. Buy Google stock or sell it on IFC. Alphabet Inc. is a holding company. The Company's segments include Google Services, Google Cloud, and Other Bets. It's easy to spend, save, and organize your cash, and it's easy to move your money to invest within minutes when you're ready. Get Google stock quote in real-time, analyze price movement and start CFD trading using our advantages of tight spreads. Buy Google stock or sell it on IFC. Leading exchanges, data providers, and buy-side and sell-side investment firms trust Google Cloud to help them reduce complexity and expand globally, securely. Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube. It is also involved in the sale of apps and in-app purchases and digital content. Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in Alphabet stock · Manage your investments in. Investors are always better served by having a clear objec- tive accompanied by a strategic investment plan. Some people invest for growth, some in- vest for.

Use Bank Of America Credit Card Before It Arrives

Using your new debit card with your current PIN to make a purchase or at any Bank of America ATM will automatically activate your card. How do I temporarily. Some banks will issue temporary cards you can use until your actual card arrives. There may or may not be a fee associated with this service. If your bank or. You'll receive your card within 10 business days after you're approved. Before you use your new card, you can activate it in one of several ways: Log in to the. Can I use a credit card before it arrives? If you want to be able to use your card as soon as you're approved, it can be helpful to consider applying for a. You do not need to have a bank account to sign up for the card. There is no credit check or minimum balance requirement. What type of federal payments can I. Use my card Make the most of your BMO credit card. Learn how to activate your card and manage it on the go with the BMO Digital Banking app. You can also let. Activating your credit card online is quick, easy and secure. We'll confirm your identity, verify your card and get you on your way. The quickest way to activate your personal credit card is with your Online Banking ID and Passcode. We'll confirm your identity, verify your card and get you. Get answers to your frequently asked questions about using your Bank of America credit and debit cards with Apple Pay®. Get answers about setting up the. Using your new debit card with your current PIN to make a purchase or at any Bank of America ATM will automatically activate your card. How do I temporarily. Some banks will issue temporary cards you can use until your actual card arrives. There may or may not be a fee associated with this service. If your bank or. You'll receive your card within 10 business days after you're approved. Before you use your new card, you can activate it in one of several ways: Log in to the. Can I use a credit card before it arrives? If you want to be able to use your card as soon as you're approved, it can be helpful to consider applying for a. You do not need to have a bank account to sign up for the card. There is no credit check or minimum balance requirement. What type of federal payments can I. Use my card Make the most of your BMO credit card. Learn how to activate your card and manage it on the go with the BMO Digital Banking app. You can also let. Activating your credit card online is quick, easy and secure. We'll confirm your identity, verify your card and get you on your way. The quickest way to activate your personal credit card is with your Online Banking ID and Passcode. We'll confirm your identity, verify your card and get you. Get answers to your frequently asked questions about using your Bank of America credit and debit cards with Apple Pay®. Get answers about setting up the.

Fill out the authorized user form and select Save & continue. Take a look at the information and if it's correct select Submit. From the account dashboard. As long as you've been actively using your Bank of America-issued AAA credit card, and your account is in good standing, you can expect your new AAA Travel. card after years without a credit card of any kind. The reasonable annual fee is worth the perks that the card offers, for instance if i use it for auto rental. Amex will provide you with your card number, a temporary four-digit identification number and an expiration date so you can use it anywhere American Express is. Step 1: Add your Bank of America® cards to your Digital Wallet. See how Step 2: Look for the Contactless Symbol in stores – it's how you know where to pay. Can I use a credit card before it arrives? If you want to be able to use your card as soon as you're approved, it can be helpful to consider applying for a. Some banks will issue temporary cards you can use until your actual card arrives. There may or may not be a fee associated with this service. If your bank or. card to arrive in the mail – start using your digital card immediately; You can shop in person or online, or even get cash from a Bank of America ATM; It's. Use the mobile app's credit card features to: Transfer higher rate balances card transactions from being processed until you take action to unlock your card. card” and use your camera or enter the card information manually. Eligible Cards. Not a Scotiabank client? Get an eligible bank account, or a credit card today. Yes, whether you use our Mobile Banking app or Online Banking, you have access to world class digital banking at your fingertips. For example, you can. credit before the physical credit card arrives in the mail. While several Bank of America® Customized Cash Rewards credit card. apply-now-icon Apply. The quickest way to activate your personal credit card is with your Online Banking ID and Passcode. We'll confirm your identity, verify your card and get you. If you'd like to set up a payment to your Bank of America credit card using another financial institution's checking or money market account, you can also set. You will not earn miles for any balance transfers or cash advances made with your Alaska Airlines credit card account or for using the Bank of America-issued. Log in to Online Banking to report your lost or stolen credit card. You can also call (outside the continental US call international collect TD Bank, America's Most Convenient Bank. About Us · Locations · Customer How do I fund my TD Connect Card using my TD Bank debit or credit card? How. Set up online banking. How do I access my BMO credit card account via online banking? A debit card looks like a credit card but works like an electronic check. Why? Because the payment is deducted directly from a checking or savings account. Check out quickly and securely – with contactless and chip technology. Plus, easily add your card to your digital wallet; Free access to your money at thousands.

What Are Secured And Unsecured Loans

For a secured loan, your credit union will hold some of your funds as collateral until your loan is paid in full. For an unsecured loan, you don't need to put. Secured loans require collateral. But whether your Affinity Plus loan is secured or not, it can help build your credit rating and earn you rewards points. A secured loan requires you to offer security or collateral to borrow money; an unsecured loan doesn't. Understanding the difference between a secured vs. Is A Home Loan Secured Or Unsecured Debt? Mortgages are "secured loans" because the house is used as collateral. This means if you're unable to repay the loan. With an unsecured loan, you're not required to put down any type of collateral. As a result, however, you may need to have a higher credit score in order to get. A secured loan is money borrowed or 'secured' against an asset you own, such as your home, whereas an unsecured loan isn't tied to an asset. A secured loan requires borrowers to offer a collateral or security against which the loan is provided, while an unsecured loan does not. This difference. If you take out a loan to buy business-related assets, but default on your payments, the finance company may repossess the assets and resell them. Yet again we. Secured loans get tied to an asset, like your home or automobile. Unsecured loans are not tied to any specific asset. Understanding these types of loans in more. For a secured loan, your credit union will hold some of your funds as collateral until your loan is paid in full. For an unsecured loan, you don't need to put. Secured loans require collateral. But whether your Affinity Plus loan is secured or not, it can help build your credit rating and earn you rewards points. A secured loan requires you to offer security or collateral to borrow money; an unsecured loan doesn't. Understanding the difference between a secured vs. Is A Home Loan Secured Or Unsecured Debt? Mortgages are "secured loans" because the house is used as collateral. This means if you're unable to repay the loan. With an unsecured loan, you're not required to put down any type of collateral. As a result, however, you may need to have a higher credit score in order to get. A secured loan is money borrowed or 'secured' against an asset you own, such as your home, whereas an unsecured loan isn't tied to an asset. A secured loan requires borrowers to offer a collateral or security against which the loan is provided, while an unsecured loan does not. This difference. If you take out a loan to buy business-related assets, but default on your payments, the finance company may repossess the assets and resell them. Yet again we. Secured loans get tied to an asset, like your home or automobile. Unsecured loans are not tied to any specific asset. Understanding these types of loans in more.

Secured loans, which “secure” the amount you borrow by requiring collateral in case you don't repay, offer a guarantee to the lender or creditor. Think of. A secured loan is a type of loan where the lender requires the borrower to put up certain assets as a surety for the loan. Secured Vs Unsecured Loans · Secured loans are protected by an asset (collateral). · Unsecured loans require no collateral. · Secured loans allow you to borrow. An easy way to think of it is this: a secured loan uses collateral where an unsecured loan doesn't. But we'll give you more than that. While secured loans can offer homeowners access to more money and lower interest rates, unsecured loans don't require you to be a homeowner and money can be. You may be eligible to get an unsecured loan even if you do not own property to put up as collateral. The application process for an unsecured loan. A secured loan requires collateral and an unsecured loan does not. Each option has different interest rates, borrowing limits, and repayment terms. What is a secured loan? A secured loan is any loan that's protected by an asset or collateral. These loans can be offered by brick-and-mortar banks, online. Compare secured vs unsecured loans for personal and business finance. Explore advantages and disadvantages of secured and unsecured borrowing features. A secured loan is normally easier to get, as there's less risk to the lender. If you have a poor credit history or you're rebuilding credit, for example. A secured loan requires borrowers to offer a collateral or security against which the loan is provided, while an unsecured loan does not. This difference. Secured debt is backed by collateral. · Examples of secured debt include mortgages, auto loans and secured credit cards. · Unsecured debt doesn't require. Any type of loan that is specifically used for the purchase of an item that can be repossessed is a secured loan. For example, mortgages are secured loans. Secured loans are tied to an asset, like your home or automobile. Unsecured loans are not tied to any specific asset. A secured loan requires the borrower to pledge some sort of asset — such as a car, property or cash — as collateral; an unsecured loan does not require. The main difference between a secured loan and an unsecured loan is whether the lender requires security. The main difference between secured and unsecured loans is collateral. While secured loans involve collateral, unsecured loans don't require you to put up. Unsecured vs. Secured Loans: What's the Difference? · What are unsecured loans used for? Unsecured loans offer versatility and can be used for many purposes. The primary difference between secured and unsecured personal loans is the presence of collateral. A secured loan requires that you use one of your assets as. A secured loan is normally easier to get, as there's less risk to the lender. If you have a poor credit history or you're rebuilding credit, for example.